Obamacare Going Up

It’s really interesting when someone can twist a fact and use sleight of hand to make something look different. You will see what I mean when you read what Jeffrey Young wrote in this Huffington Post:

Health insurance premiums are going to skyrocket under Obamacare next year, maybe even double! No, wait — they’re only increasing a little, and less than before Obamacare! No, wait — they’re … decreasing in some places?

The crucial question about the second year of enrollment on the Affordable Care Act’s health insurance exchanges is: How much will coverage cost? Actual prices won’t be available in most states until the exchanges open Nov. 15, or shortly before that, so consumers are left to sort through political spin and preliminary reports that don’t make things any clearer.

So what’s going on? First, most people will pay more for health insurance next year. That’s true whether you get coverage from a job, on your own through an exchange or directly from an insurer, or from Medicare. Health insurance prices tend to go up. It’s their nature, and it’s closely tied to how much the cost of medical care rises.

The good news is that available information indicates the doomsayers were wrong, and premiums under President Barack Obama’s health care law aren’t going through the roof.

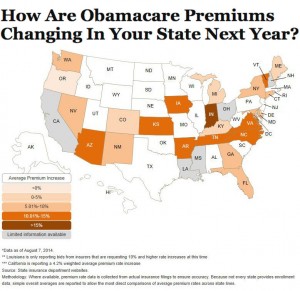

The average increase for Obamacare plans will be 8.2 percent next year in 29 states and the District of Columbia where data about health insurance premiums for 2015 are available, according to PricewaterhouseCoopers, which has conducted the most thorough review to date. That’s significant, but it’s a little lower than the 10 percent annual rate hikes typical before the Affordable Care Act, according to a recent analysis published by the Commonwealth Fund.

I am paying $13,000 a year for a Bronze plan on the exchange. The worst plan. Each member of my family has a $5000 deductible and the whole family has a $12,000 deductible. This is expected to go up 10-15% next year! I am supposed to be happy with this? Wasn’t this debacle called the AFFORDABLE Care Act? Jeffrey, I don’t know who these doomsayers are but I would say premiums are going through the roof as well. Your agenda is clear, however, and that is to be a minion and mouthpiece for the government and this terrible piece of legislation. For your information, just because it’s a little lower than the 10 percent annual hikes before doesn’t mean it worked. Everyone is getting a 3.8% tax to pay for this so who really came out ahead? Or did you forget that part?

This is beautiful — the individual mandate is a scam, so they push the employer mandate back until after the midterms… but why not add another two years to allow Senator Secretary HilBill take the mantle that is her entitlement? Watch for another delay.

My fellow Heinleinians will recognize “tanstaafl”, but the rest of you may need to have it spelled out: There ain’t no such thing as a free lunch. Yeah, tax money will end up paying for those who couldn’t get insured before. But if you are told your cancer treatment won’t be covered because it was started under a different insurance company, or you have to decide between college for your kid or a cholecystectomy, or if your fibroids make you miserable all month and no gynecologist will touch you outside of County General (and even those guys charge according to your calculated ability to pay), you just might feel differently. I’m saving my sympathy for those who STILL can’t get a colonoscopy no matter how constipated and anemic they are, and who wouldn’t be able to get surgery anyway since it’s considered “elective”.

Jeffrey Young is one of the many Kool-Aid drinkers who bought the Democratic promises hook, line and sinker. His IQ obviously hasn’t reached room temperature, like many HuffPo contributors.

The ACA is just a tax. Federal workers dont pay it, they get employee health care, so they dont care. Retirees dont pay it. Illegals dont pay it. The same uninsured drug dealers wont buy it.

In Canada everyone pays into the system via a national sales tax. Drug dealers, contractors taking under the table payments. If you make less, you pay less, on the other hand if you were making money and not telling the truth when you spend it you pay a fair tax.

A Doctor making 200k is now in the highest tax bracket.

Those CEOs and entertainers making a million a year, 20,000 in health care costs are just a 2% tax.

But if you make 200k and pay 20k in health insurance and deductibles, it is another 10% tax. Add that to your children not qualifying for college aid, like the bottom half, and pretty soon you are in a 50 or even 60% tax bracket.

That is why the very rich, the poor and the federal workers wanted ACA , they either get it free or it is just a 2% tax to them. (throwing out the new Medicare 3.8% tax )

We need a national sales tax to pay for a basic level bronze healthcare system for trauma, generic, treatments.

My premium has increased by over 20% (Florida) – I’d like chowderhead Jeffrey to explain what I’m getting in return for that increased cost.

“Everyone is getting a 3.8% tax to pay for this so who really came out ahead?”

Ummmmm… The insurance companies?

Just a wild guess.

‘Cause my “merit raise” sure as hell was less than the rate of inflation, meaning MY income is decreasing.