Federal Higher Education Funding – The Good, The Bad & The Ugly

The benefit a nation derives from having a highly educated and productive group of citizens was evident post W.W. II. Over 2 million returning war-hardened veterans took advantage of G.I. Bill grants to attend college and graduate school, along with a small amount for living expenses. They were mature, capable and serious students who in 1947 composed almost half of the student body and quickly became the backbone of America’s burgeoning middle class (Ref.1).

The federal government in 1958 experimented with loans (needed to be repaid) rather than grants (no need for repayment) creating the National Defense Education Act to be able to loan students monies for post-secondary education. Seven years later, wanting to expand student loans, this program was terminated for other alternatives.

One was “Pell Grants” created by Congress in 1965 in which deposits are made to the university/college for tuition and fees based on student need. Left over monies, if any, are returned to the student. In 2018 the amount was up to $6,495/student (Ref.2). This program has proven to be quite successful.

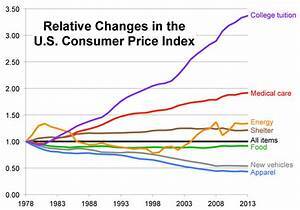

Also, in 1965 the federal government initiated a guaranteed loan program (government pays if student defaults) from banks and other commercial sources with funds going directly to students attending an accredited institution for post-secondary education. Attempting to save money by eliminating the middlemen, Congress in 1992 created direct government loans, competing with the guaranteed commercial loan program. Apparently, Congress was unconcerned that higher education costs were already spiraling out of control (see graph). Then on July 1, 2010, using Congressional Budget Office estimates that government loans directly to students would create a profit for the government of $68.7 billion over ten years, ALL government guaranteed loans were eliminated in favor of direct lending and future profits (Ref.3). As stated by Yogi Berra, “Making predictions is difficult, especially about the future”. Instead of being financially viable this federal loan program has led to financial disaster for millions of young people as well as for the federal government. Funds were loaned without regard to the students’ ability for academic achievement. As any economist would have predicted, the onslaught of funds, with constant supply, led to an explosion of costs far exceeding inflation (Ref.4).

Presently about 45 million young Americans owe about $1.7 trillion dollars to the federal government for loans they received to promote their higher education. Many youngsters were not prepared for the rigors of higher education and prematurely left school having had accumulated significant debt. They returned to jobs paying wages not at the college graduate level, thus remain heavily indebted. An especially egregious example of student indebtedness is the film master’s program at Columbia University costing about $181,000 with graduating salaries of about $30,000 (Ref.5). With the present level of student debt, exacerbated by the Covid-19 pandemic, there is now a raging debate about loan forgiveness, ironic for a program that supposedly was to make a profit for the government. There is little doubt that the federal higher education loan program is long overdue for drastic reform. It is largely responsible for the prohibitive costs of obtaining a medical degree.

Should the Pell granting program be expanded and loans eliminated? Or, in addition, should the universities/colleges be the loaning entity thereby fostering value for the students?

- Suzanne Mettler, How The G.I. Bill Built The Middle Class And Enhanced Democracy, Cornell University, January 2012, available at: https://scholars.org/sites/scholars/files/ssn_key_findings_mettler_on_gi_bill.pdf#:~:text=Following%20World%20War%20II%2C%20the%20%E2%80%9CServicemen%E2%80%99s%20Readjustment%20Act,vibrant%20in%20the%20middle%20of%20the%20twentieth%20century. (Accessed July 18, 2021)

- Mark Kennan, Do Pell Grants Get Direct Deposited Into Your Account?, The Classroom, August 23, 2018, available at: https://www.theclassroom.com/do-pell-grants-get-direct-deposited-into-your-account-13605270.html (Accessed July 18, 2021)

- New America, Student Loan History, Education Policy, available at: – https://www.newamerica.org/education-policy/topics/higher-education-funding-and-financial-aid/federal-student-aid/federal-student-loans/federal-student-loan-history/#:~:text=The%20federal%20government%20began%20guaranteeing%20student%20loans%20provided,called%20the%20Federal%20Family%20Education%20Loan%20%28FFEL%29%20program. (Accessed July 19, 2021)

- Erik Sherman, Zenger News, College Tuition Is Rising at Twice the Inflation Rate – While Students Learn At Home, Forbes, August 31, 2020, available at: https://www.forbes.com/sites/zengernews/2020/08/31/college-tuition-is-rising-at-twice-the-inflation-rate-while-students-learn-at-home/ (Accessed July 24, 2021)

- Melissa Korn & Andrea Fuller, ‘Financially Hobbled for Life’: The Elite Master’s Degrees That Don’t Pay Off, Wall Street Journal, July 8, 2021, available at: https://www.wsj.com/articles/financially-hobbled-for-life-the-elite-masters-degrees-that-dont-pay-off-11625752773 (Accessed July 9, 2021)

How about making the student debt dischargeable in a banruptcy? My understanding is the rule changed in the 1970’s, somewhat coincident with the sharp rise in college cost.

Public college should be free. But the spots should be adjusted to the jobs in each field. In other words to get an art degree would require a portfolio submitted for admission and a limited number of spots to the people who can actually have a viable living. Since each state controls its university budget there will be feedback loop to control costs.

However room and board is not free and thus would control the objective to build fancy dorms. Students can work if needed to cover their room and board.

Government should get out of the loan business altogether. With it getting out of a loan business that would allow the money for the public colleges.

Private college should have no loans at all. If you want to go to private school you take out a lo an from that college. Those colleges will make certain their costs are reasonable and people will get jobs if they are on the line for the tuition. They can use their endowments for scholarships.

The public should realize in Europe or in countries where college is free, room and board is not free, many live and work at home rather than dormitories, and spots are limited. In other words you have to do well in high school to get that free college.